riverside county sales tax calculator

The Riverside California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Riverside California in the USA using average Sales Tax Rates andor. Welcome to the Riverside County Property Tax Portal.

Missouri Sales Tax Rates By City County 2022

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. Riverside County Sales Tax Rates for 2022. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Sales tax in Riverside County California is currently 775.

The current total local sales tax rate in Riverside County CA is 7750. This is the total of state and county sales tax rates. What is the sales tax rate in Riverside County.

The December 2020 total local sales tax rate was also 7750. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. This rate includes any state county city and local sales taxes.

Method to calculate Riverside County sales tax in 2021. Riverside Countys average effective tax rate of 110 is the second-highest in the state of California after Kern County. This includes the rates on the state county city and special levels.

The minimum combined 2022 sales tax rate for Riverside County California is. The base sales tax in California is 725. The Riverside Illinois sales tax is 1000 consisting of 625 Illinois state sales tax and 375 Riverside local sales taxesThe local sales tax consists of a 175 county sales tax a 100.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 832 in Riverside County. Median home values vary widely in. Sales Tax Table For Riverside County California.

The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Riverside is located within Riverside County.

Riverside County Property Tax Rates. 951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce.

The average cumulative sales tax rate in Riverside California is 863. The sales tax rate for Riverside County was updated for the 2020 tax year this is the current sales tax rate we are using in the. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county.

Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in. For comparison the median home value in Riverside County is. Method to calculate Riverside sales tax in 2022.

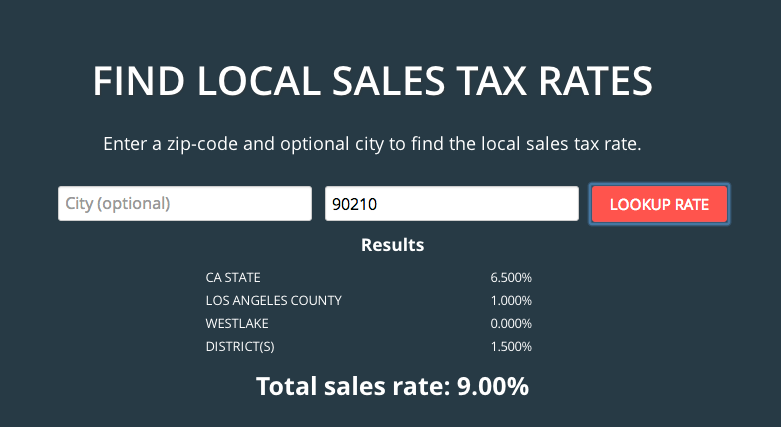

For a list of your current and historical rates go to the california city county sales use tax rates webpage. The local sales tax rate in Riverside County is 025 and the maximum rate including California and city sales taxes is 1025 as of October 2022. Sales Tax Calculator Riverside Ca TAXW from.

Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone. Choose city or other locality from Riverside. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

0275 0385 san. The latest sales tax rate for Desert Center CA. 2020 rates included for use while preparing your income tax deduction.

Riverside County Assessor County Clerk Recorder Home Page

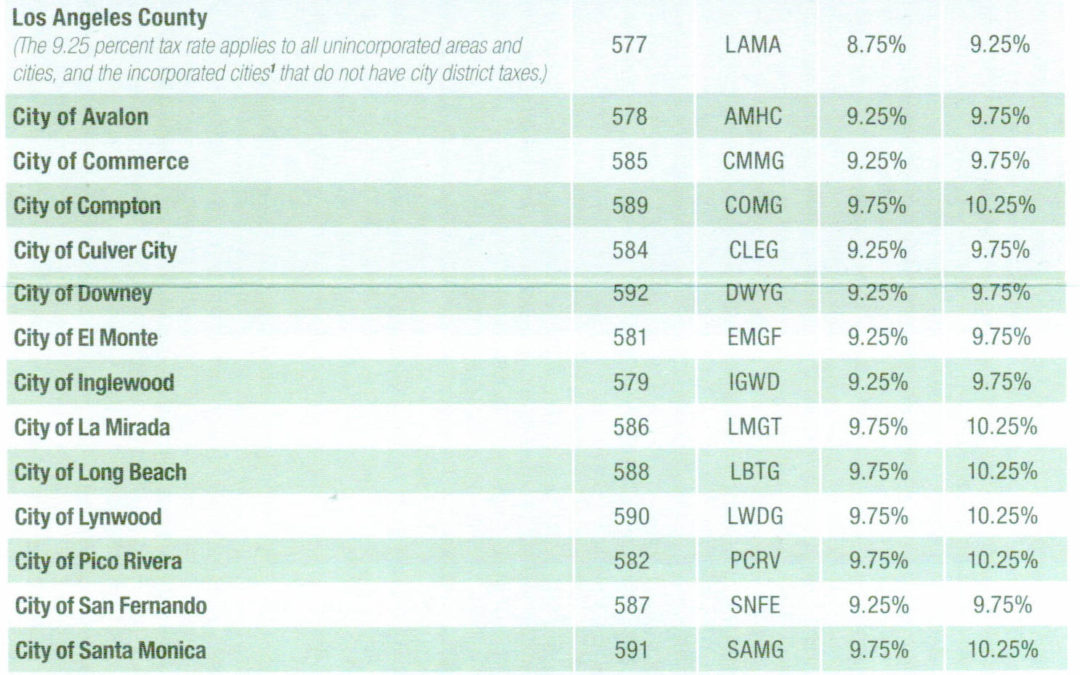

La County Sales Tax Increase July 2017 Affordable Bookkeeping Payroll

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Riverside County Ca Property Tax Search And Records Propertyshark

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

California Used Car Sales Tax Fees 2020 Everquote

La Quinta Tax Rate Now At 8 75 State Reminds Consumers Merchants Of Current Rivco Rates Palm Desert Ca Patch

How To Collect Sales Tax Through Square Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

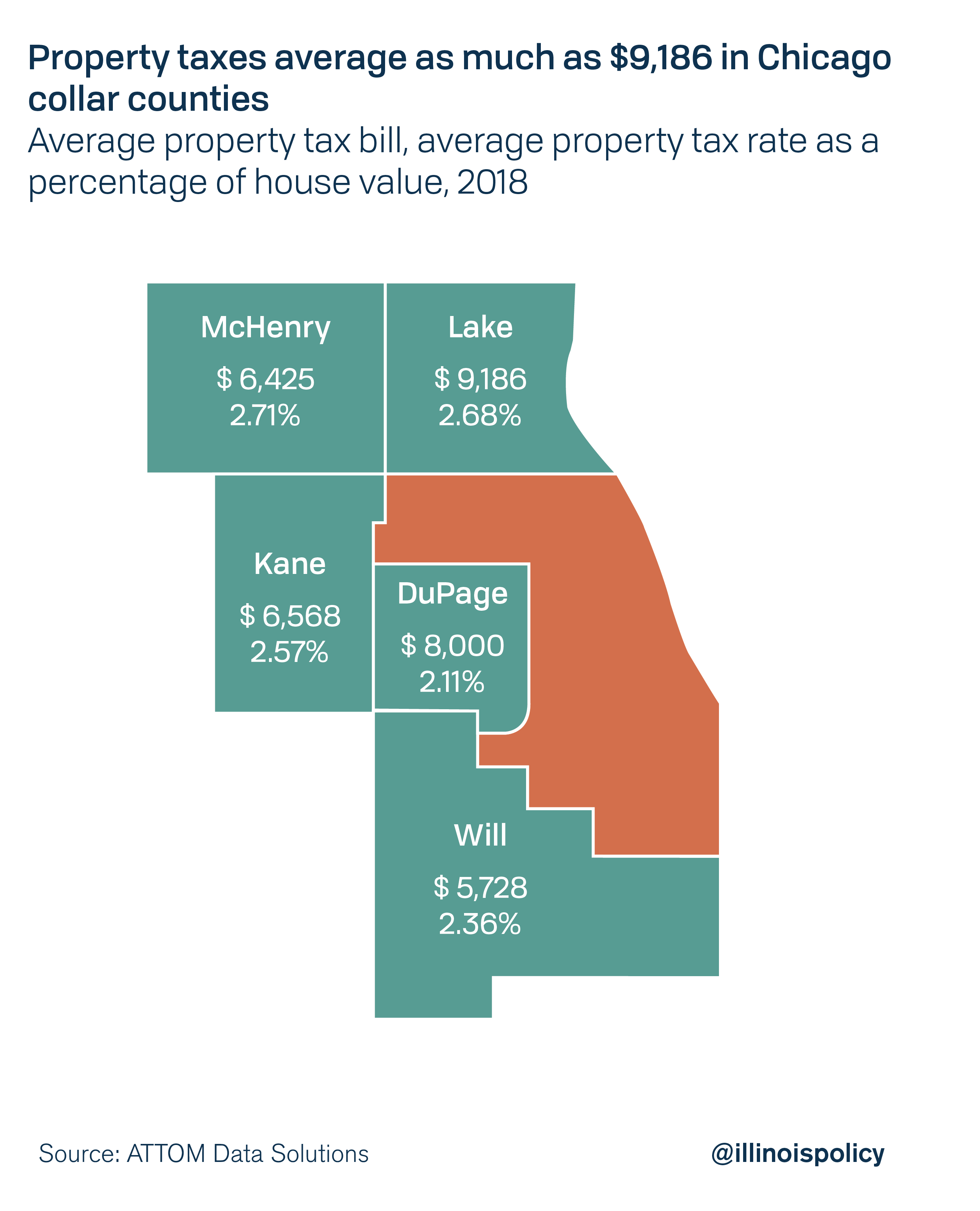

Lake County Residents Pay Some Of The Highest Property Taxes In The Nation

Washington Sales Tax Rates By City County 2022

.jpg)

Bid4assets Riverside County California Tax Sale Information

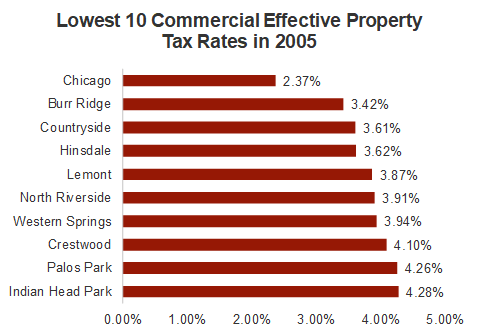

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

City Of Roswell Property Taxes Roswell Ga

Food And Sales Tax 2020 In California Heather

The Cook County Illinois Local Sales Tax Rate Is A Minimum Of 8

Riverside County Assessor County Clerk Recorder Supplemental Tax Bills