accumulated earnings tax form

If you see a 0. Instant access to fillable Microsoft Word or PDF forms.

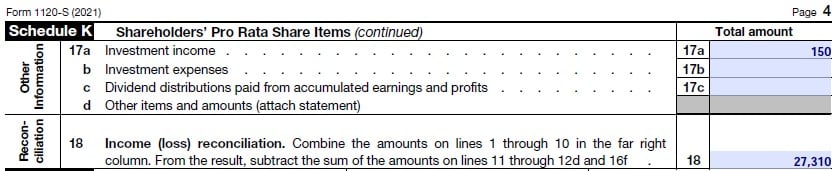

How To Complete Form 1120s Schedule K 1 With Sample

The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys corporate tax return.

. Largest forms database in the USA with more than 80000. S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return Irs. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Instant access to fillable Microsoft Word or PDF forms. Ordering tax forms instructions and publications. This bir form is to be filed by every domestic corporation classified as closely-held corporation except banks and other non-bank financial intermediaries insurance companies taxable.

Call 800-829-3676 to order prior-year forms and. CORPORATIONS SUBJECT TO TAX. Application For Earnings Witholding Order For Taxes WG-020 Start Your Free Trial 1399.

Subtract line 11 from line 10. Add line 12 and line 13. If line 11 is greater than line 10 enter 0.

Minimize the risk of using outdated forms and eliminate rejected fillings. Go to IRSgovOrderForms to order current forms instructions and publications. These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report.

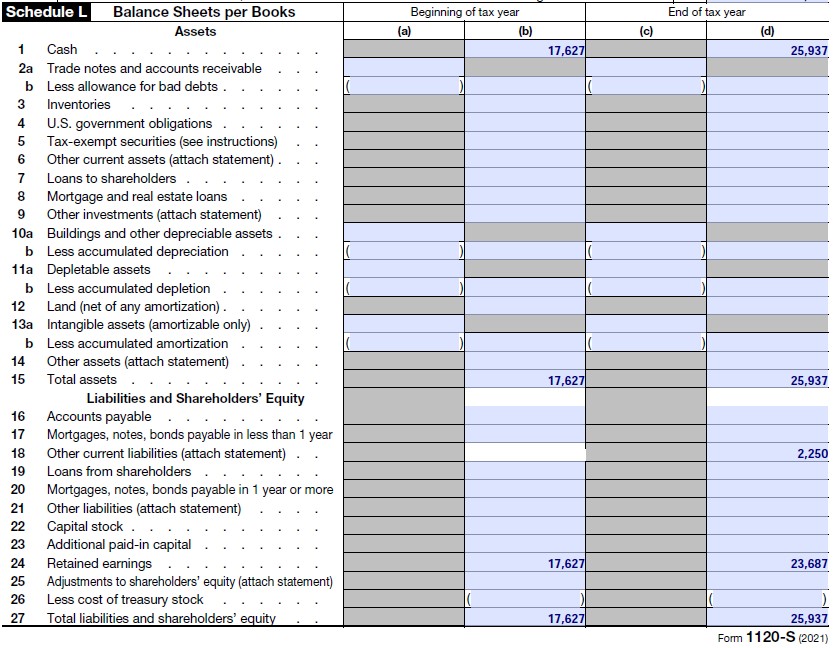

Form 1099G tax information is available for up to five years through UI Online. If an adjustment was made to your Form 1099G it will not be available online. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3.

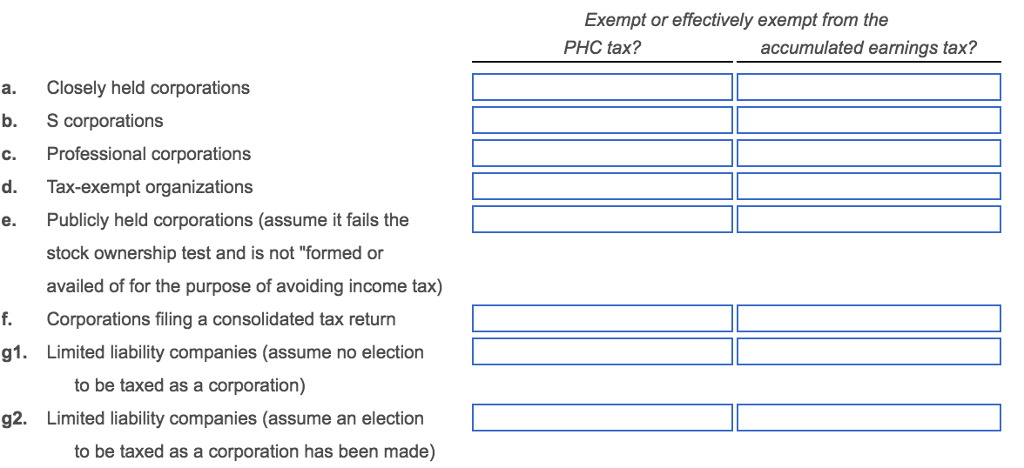

See General Information O. The accumulated earnings tax applies to every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. Accumulated tax earning is a form of encouragement by the government to give.

Determining The Taxability Of S Corporation Distributions Part Ii

Instructions For Filing Form 1120 S Us Income Tax Return For An S Corporation Lendstart

Double Taxation Of Corporate Income In The United States And The Oecd

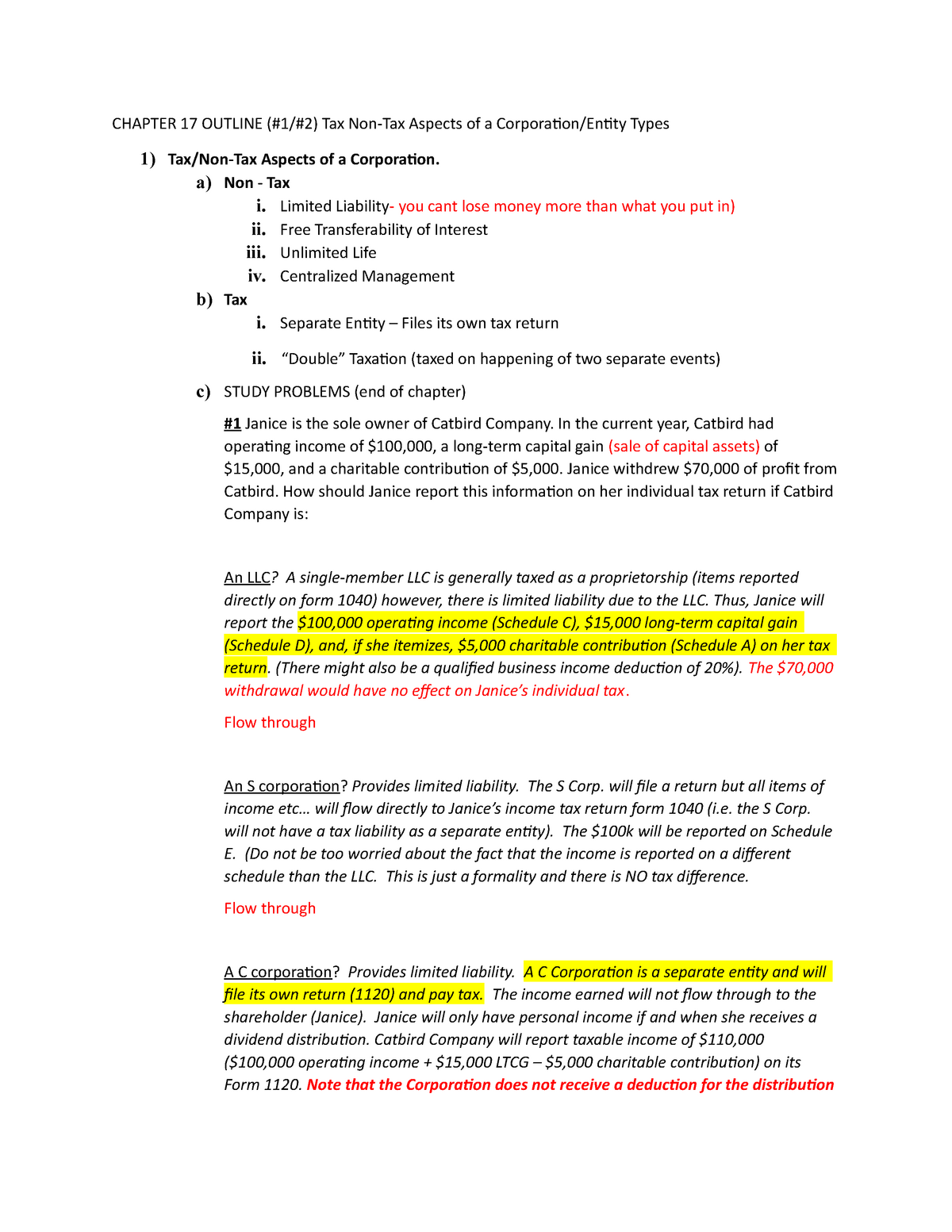

Chapter 17 Ch 17 Chapter 17 Outline 1 2 Tax Non Tax Aspects Of A Corporation Entity Types 1 Studocu

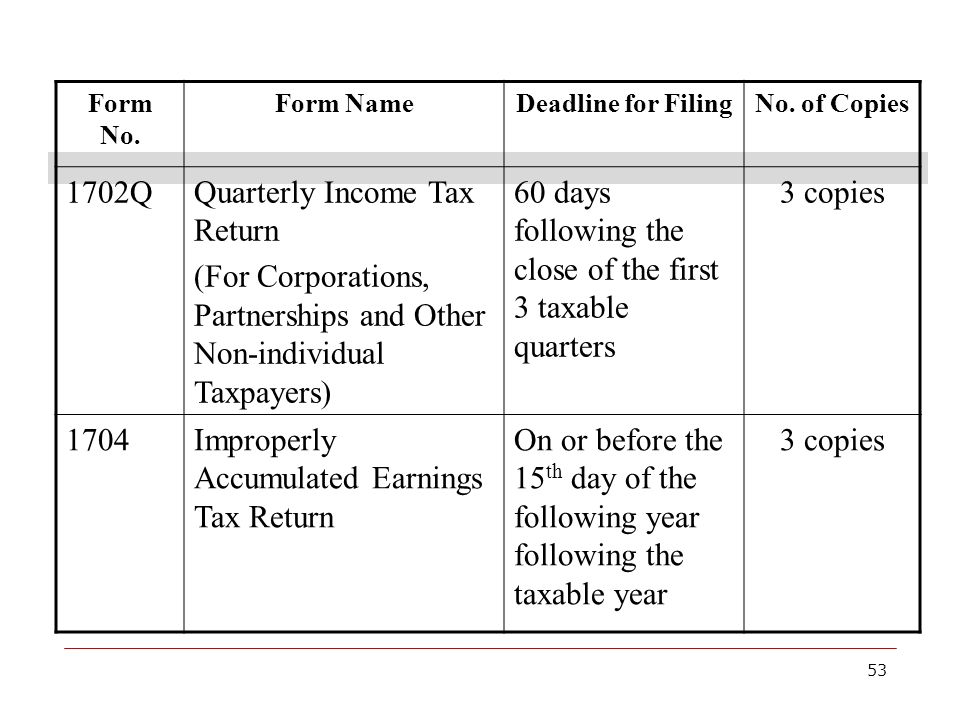

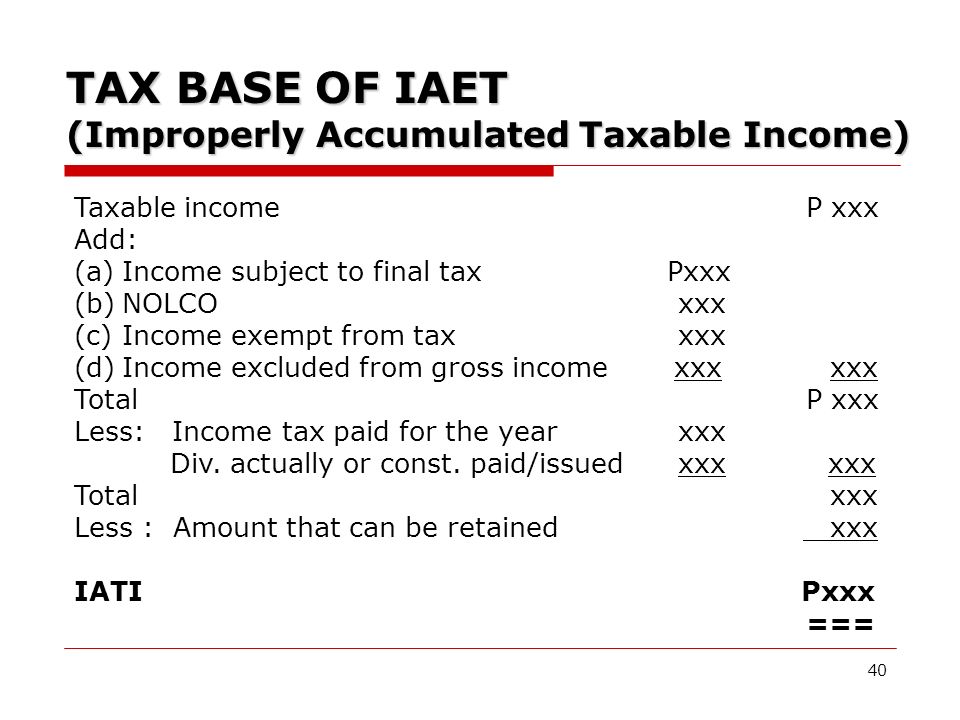

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Business Tax Quick Guide Tax Year 2021

How To Prepare An S Corporation Tax Return Online Tax Professionals

Are Retained Earnings Taxed For Small Businesses

How To Complete Form 1120s Schedule K 1 With Sample

Earnings And Profits Computation Case Study

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Schedule E 1 Taxes Paid Or Deemed Paid Irs Form 5471 Youtube

Which Of The Following Corporate Forms Are Exempt Chegg Com

Form 5471 Schedule J Accumulated Earnings And Profits E P Of Controlled Foreign Corporation

Determining The Taxability Of S Corporation Distributions Part Ii

1120 Ef Message 0042 Schedule M 2 Is Out Of Balance

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments